Historical Price Analysis of Gold Jewelry and Key Market Shifts

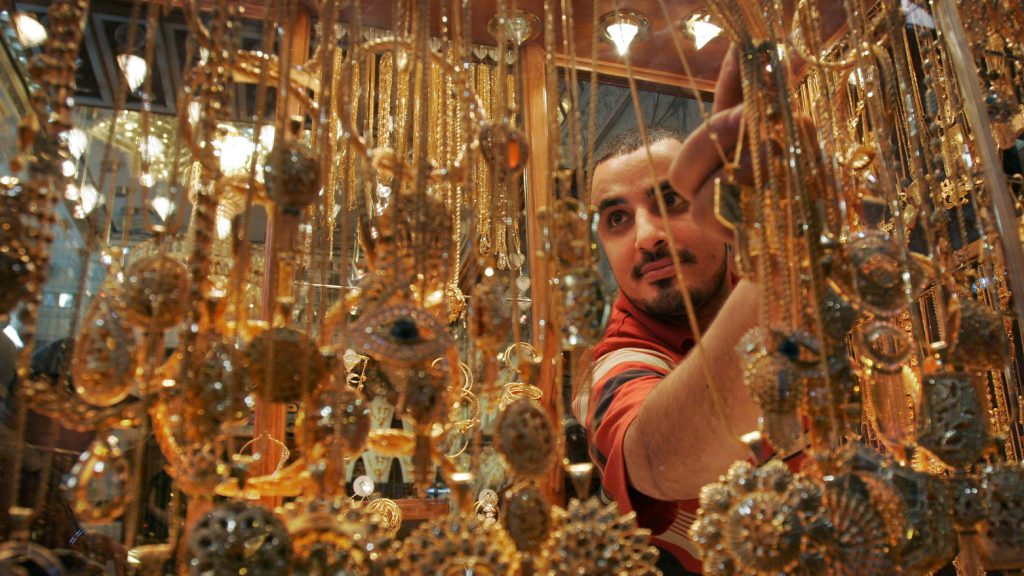

Gold jewelry has been a cornerstone of wealth, culture, and artistry for thousands of years. Its value, both symbolic and monetary, has seen dramatic evolutions shaped by economic trends, cultural shifts, and market innovations. Understanding how gold jewelry prices have evolved provides valuable insights for investors and collectors alike. Historically, gold jewelry pricing was closely tied to the weight and purity of the metal itself, with little regard for design or craftsmanship outside of royal or aristocratic circles. However, as global economies expanded, the 20th and 21st centuries introduced major market shifts. In the post-World War II era, as global economies recovered, gold prices remained relatively stable, and jewelry was widely accessible. Yet, the 1970s saw a pivotal shift when the United States abandoned the gold standard, leading to the free-market valuation of gold. This change caused gold prices to soar, nearly quadrupling within a few years. Jewelry pricing, in turn, became more volatile, aligning more directly with the spot price of gold.

In the 1980s and 1990s, inflation fears, fluctuating currencies, and emerging global markets, particularly in Asia, continued to influence gold prices. Jewelry trends evolved as well; brands like Tiffany & Co., Cartier, and Bulgari began to emphasize not just the material value but also the artistic and brand value of their pieces, adding premiums that often far exceeded the intrinsic value of the gold itself. The early 2000s witnessed another wave of change. As emerging economies like China and India experienced rapid wealth creation, demand for gold jewelry surged. Simultaneously, economic instability, particularly the 2008 financial crisis, pushed investors toward tangible assets, including luxury jewelry. Gold prices peaked, and luxury jewelry became an even more potent symbol of wealth preservation. In the last decade, the rise of sustainable and ethically sourced jewelry, combined with digitalization, has further transformed the market. Online auctions, resale platforms, and blockchain authentication are now integral parts of the gold jewelry investment landscape, adding complexity and opportunity for today’s buyers.

How Jewelry Designers and Consumers Are Responding to Changes in Gold Prices

Both jewelry designers and consumers have adapted in innovative ways to the fluctuating price of gold. Designers, faced with soaring raw material costs, have sought creative solutions. One approach has been to reduce the weight of gold used in each piece without sacrificing aesthetic appeal. Hollow gold jewelry, minimalist designs, and the incorporation of alternative materials like enamel, gemstones, and even recycled metals have allowed designers to maintain price accessibility while preserving luxury appeal. Another response has been the emphasis on craftsmanship and storytelling. Brands increasingly highlight the artisanal processes behind each piece—hand-forging, bespoke customization, and sustainable sourcing—to justify higher price points and create emotional value that transcends material costs.

Consumers, on the other hand, have become more discerning and strategic. The modern jewelry buyer is better informed, often researching gold purity, hallmark standards, and brand reputation before making a purchase. Buyers are also more open to purchasing vintage and pre-owned jewelry, seeing these pieces as offering better value due to their established market appreciation and historical significance. The sustainability movement has further shaped consumer behavior. Ethical sourcing, fair-trade gold, and environmentally responsible manufacturing processes are no longer niche concerns but mainstream expectations, especially among younger demographics. Brands that transparently showcase their commitment to these principles can command loyalty and premium pricing, even when gold prices are volatile. Digital platforms have empowered consumers with access to international markets and investment-grade jewelry options. From live-streamed auctions to blockchain-verified certificates of authenticity, the jewelry buying process has evolved dramatically, offering both transparency and competitive pricing that were previously unavailable to the average buyer.

Future Price Predictions and Investment Opportunities in the Jewelry Market

Looking ahead to 2025 and beyond, several factors are poised to influence gold jewelry prices and create new investment opportunities. First, macroeconomic uncertainty continues to drive demand for tangible assets. Gold remains a safe-haven investment during times of inflation, currency devaluation, or geopolitical tension. As a result, demand for high-quality gold jewelry, particularly investment-grade pieces from established brands, is expected to remain strong. Second, global wealth redistribution is reshaping market dynamics. Middle-class expansion in emerging economies, combined with generational wealth transfer in developed markets, is broadening the base of luxury consumers. Younger buyers are not only interested in luxury jewelry for aesthetic reasons but are also viewing it as a viable investment vehicle.

Third, technological innovation will play a bigger role. Blockchain authentication, AI-driven appraisal tools, and virtual showrooms are making gold jewelry investment more transparent, secure, and accessible. Investors who leverage these tools can better identify undervalued pieces and monitor market trends in real time. Fourth, sustainability will continue to be a major market force. Investment in ethical jewelry is not just a moral decision but a strategic one, as these pieces are expected to outperform traditional jewelry in long-term value appreciation due to growing consumer preference for responsible luxury.

Expert forecasts suggest that gold prices could experience moderate to significant fluctuations in 2025, driven by central bank policies, global political tensions, and shifts in supply and demand dynamics. While short-term dips are possible, the long-term trajectory for gold jewelry investment remains positive, particularly for pieces that combine material value with brand prestige and unique craftsmanship. For investors, the key strategy is diversification within the gold jewelry sector. This means not only acquiring pieces based on intrinsic gold value but also seeking out limited-edition collections, vintage pieces with historical significance, and jewelry from highly reputable brands. Staying informed on market trends, using certified appraisal services, and timing purchases around seasonal sales or economic lulls can significantly enhance investment returns.

In conclusion, the evolution of gold jewelry prices reflects a complex interplay of economic, cultural, and technological factors. As the market continues to evolve, savvy investors who understand these dynamics and approach gold jewelry with a strategic, informed mindset are well-positioned to capitalize on both its enduring beauty and its investment potential.