How Inflation Impacts Gold Historically and Currently

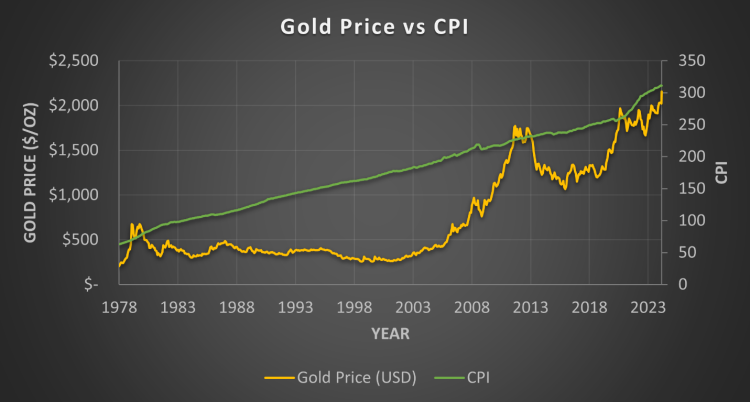

Gold has long held a reputation as a safe haven against inflation, a status built through centuries of economic turbulence. Historically, during periods of rising prices and declining purchasing power, gold has often outperformed other assets by preserving value when fiat currencies faltered. Experts analyzing historical data show that during significant inflationary episodes—such as the 1970s oil crisis—gold prices surged dramatically, offering investors a tangible hedge against economic instability. The 1970s, in particular, offer a textbook case: as U.S. inflation soared to double digits, gold prices rose from around $35 per ounce in the early decade to over $800 by 1980, dramatically outpacing consumer price increases and stock market performance. However, experts caution that the relationship between gold and inflation is not always straightforward. Gold does not respond linearly to every uptick in inflation. Instead, it reacts more strongly to unexpected inflation—when actual inflation exceeds market expectations. In periods where inflation is stable and anticipated, gold’s performance may be more muted. Analysts point to the 1980s and 1990s as decades when, despite moderate inflation, gold underperformed compared to equities due to the broader environment of strong economic growth and rising interest rates. Currently, as the world grapples with renewed inflationary pressures driven by supply chain disruptions, fiscal stimulus, and geopolitical tensions, the role of gold as an inflation hedge is under intense scrutiny once again. Over the past few years, gold has seen mixed reactions: initial surges during the onset of the pandemic, followed by periods of consolidation. Experts argue that gold’s recent behavior reflects the complex interplay between inflation, interest rates, and monetary policy. In an environment where central banks aggressively raise interest rates to combat inflation, the opportunity cost of holding non-yielding assets like gold increases, sometimes putting downward pressure on prices despite rising consumer costs. Nonetheless, many experts maintain that over the long term, gold continues to offer protection against sustained inflation, particularly when adjusted for real interest rates—the nominal rate minus inflation. When real rates are deeply negative, as they have been periodically since 2020, gold tends to perform better, reinforcing its historical role as a store of value.

Forecasting Gold’s Performance Amid Rising Global Prices

As inflation persists and global economic uncertainties loom, forecasting gold’s performance becomes a critical exercise for investors seeking to protect their wealth. Experts use a variety of models and indicators to project future gold price behavior, often focusing on inflation expectations, real interest rates, central bank policies, and geopolitical risk factors. One consistent theme among forecasts is that gold tends to thrive when real interest rates are negative or falling. When investors see their cash holdings eroded by inflation faster than they can earn returns in savings accounts or bonds, the allure of gold increases. Current projections suggest that if inflation remains stubborn while interest rate hikes slow or reverse—perhaps due to recession fears—gold could experience a significant upward trajectory. Some analysts predict that in such a scenario, gold could breach previous all-time highs, potentially surpassing $2,500 per ounce by late 2025. Additionally, the growing demand from central banks, which are increasingly diversifying into gold to reduce dollar exposure, is expected to provide a strong foundational support for prices. According to the World Gold Council, central banks purchased a record amount of gold in 2022 and have maintained robust buying patterns into 2025. This consistent demand from institutional players reduces available supply and can act as a price floor even in volatile markets. Another factor influencing forecasts is investor sentiment towards inflation-hedged assets broadly. With cryptocurrencies showing extreme volatility and traditional inflation-protected bonds offering mixed returns, gold remains a tried-and-tested asset for wealth preservation. Experts note that portfolio diversification strategies are increasingly allocating a greater share to gold and gold-related assets, reinforcing positive price momentum. However, experts also acknowledge downside risks. If inflation were to suddenly retreat faster than expected due to aggressive monetary tightening or technological advances reducing supply-side bottlenecks, gold’s appeal could wane. Furthermore, if real yields turn significantly positive and alternative safe-haven assets become more attractive, gold prices could face headwinds. Geopolitical developments add another layer of complexity to forecasts. Continued tensions between major powers, trade wars, or unexpected global crises typically boost gold’s appeal. Conversely, periods of sustained peace and global economic cooperation could shift investor attention away from defensive assets. Looking at the data, macroeconomic models suggest a broad bullish bias for gold over the next few years, albeit with periodic corrections. Analysts emphasize that gold’s path will likely be volatile, reflecting the push and pull of inflation dynamics, monetary policy responses, and broader market sentiment. As a result, strategic investors are advised not just to focus on short-term price movements but to consider gold as part of a longer-term inflation-hedging and portfolio diversification strategy.

Conclusion

The question of whether gold can outpace inflation remains central to investment strategies in a world of economic uncertainty. Historical data overwhelmingly supports the notion that gold is an effective long-term hedge against inflation, particularly during periods of unexpected price surges and negative real interest rates. Current market conditions—characterized by persistent inflation, central bank monetary maneuvering, and geopolitical instability—suggest that gold retains significant potential to outperform many traditional assets. However, experts also warn that gold’s relationship with inflation is nuanced, influenced by real interest rates, monetary policies, and broader investor sentiment. Forecasts indicate a cautiously optimistic outlook for gold, with potential for record highs if inflation proves stubborn and economic uncertainties persist. For investors seeking a shield against inflation and a stabilizing force within their portfolios, gold continues to offer compelling advantages. As always, diversification, patience, and a keen eye on macroeconomic signals will be key to maximizing the benefits of gold investments in an inflationary world.