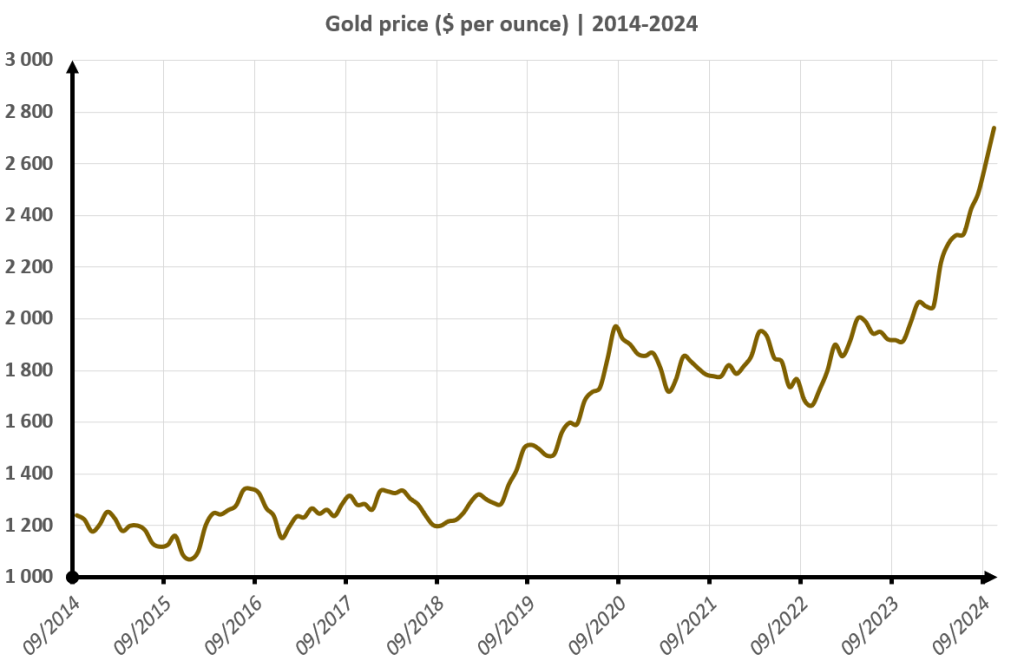

As we move toward 2025, many investors are looking to gold as a reliable asset class to hedge against financial uncertainty, inflation, and market volatility. Historically, gold has proven to be a stable investment during times of economic distress. However, the question on everyone’s mind is: what will drive the price of gold in the coming year? In this article, we will explore expert insights on the key factors influencing gold prices in 2025, including inflation, currency fluctuations, and global demand. We will also dive into the tools and techniques used to forecast gold price movements and discuss expert strategies for investing in gold during the upcoming year.

Expert Opinions on What Could Drive Gold Prices in 2025

Gold’s price movements are influenced by a wide array of factors, ranging from economic indicators to geopolitical tensions. As we enter 2025, the consensus among experts is that several key elements will play a crucial role in shaping gold’s price trajectory. Here are some of the most important factors to watch:

- Global Inflationary Pressures Inflation has been one of the most significant drivers of gold prices in recent years. When inflation rises, the purchasing power of paper currencies declines, which makes gold more attractive as a store of value. Many analysts predict that inflation will continue to be a key theme in 2025, especially in developed economies where central banks have maintained accommodative monetary policies in response to global challenges such as the pandemic and supply chain disruptions. Higher inflation could push investors to seek the stability of gold, leading to price increases.

- Currency Fluctuations and US Dollar Performance Gold is priced in US dollars, meaning fluctuations in the value of the dollar have a direct impact on gold prices. If the dollar weakens relative to other currencies, gold becomes more affordable for foreign buyers, which can drive up demand and, subsequently, prices. Conversely, a strong dollar could exert downward pressure on gold prices. Experts suggest that the US Federal Reserve’s stance on interest rates and its policy decisions regarding the dollar will be critical factors to monitor in 2025.

- Geopolitical Tensions and Global Instability Geopolitical events, such as military conflicts, trade disputes, and political instability, often cause uncertainty in financial markets. During times of geopolitical stress, investors flock to gold as a safe-haven asset. The ongoing tensions in regions like Eastern Europe, the Middle East, and parts of Asia, combined with the potential for new crises, could contribute to gold’s appeal as a protective asset. Experts foresee continued geopolitical instability in 2025, which could keep gold prices elevated as investors seek refuge in this timeless asset.

- Central Bank Policies and Global Demand Central banks play a significant role in shaping gold prices through their monetary policies. In recent years, many central banks have increased their gold reserves as part of their strategy to diversify from traditional fiat currencies. This trend is expected to continue into 2025, as central banks remain cautious amid economic uncertainty. Increased demand for gold from central banks, along with rising demand from emerging markets, particularly China and India, could further support price gains in 2025.

Factors Like Inflation, Currency Fluctuations, and Global Demand

Let’s take a deeper look at how these factors interact and influence gold prices:

- Inflation and Interest Rates Gold tends to perform well in environments of high inflation and low interest rates. This is because inflation erodes the value of fiat currencies, while low interest rates make other assets, like bonds, less attractive. With inflation remaining high in many economies and central banks adopting dovish monetary policies to support growth, gold is likely to remain a favored asset in 2025.

Moreover, as central banks like the US Federal Reserve continue to grapple with inflation and economic growth, their interest rate decisions will have significant repercussions on gold’s performance. If central banks slow their rate hikes or maintain a dovish stance to support growth, gold may continue to rise in value as investors seek alternatives to low-yielding bonds.

- Currency Fluctuations and the US Dollar The value of the US dollar is another crucial determinant of gold prices. A weaker dollar typically results in higher gold prices, as gold becomes more affordable for foreign buyers. In recent years, the dollar’s fluctuations have been driven by the Federal Reserve’s monetary policy and economic conditions in the US. In 2025, experts predict that the dollar will likely experience some weakness due to ongoing inflation concerns and a potential slowdown in economic growth. If this happens, gold could become more attractive to international investors, further driving up prices.

- Global Demand from Emerging Markets The demand for gold in emerging markets, particularly in China and India, is another factor that will play a significant role in 2025. In these countries, gold is often seen as a cultural and financial asset, with consumers purchasing gold for jewelry, investment, and savings. As global middle-class populations expand, demand for gold in these regions is expected to grow, providing upward pressure on gold prices. Additionally, central banks in these regions are likely to continue diversifying their reserves by adding gold, which will further increase global demand.

Price Analysis Tools and Techniques for Forecasting Gold’s Movement

Accurately predicting gold price movements requires the use of various tools and techniques that analyze historical data, economic indicators, and market sentiment. Some of the most commonly used methods for forecasting gold prices include:

- Technical Analysis Technical analysis involves studying historical price charts and identifying trends, patterns, and key support and resistance levels. By analyzing price movements over time, technical analysts attempt to forecast where gold prices may head in the future. Common indicators used in technical analysis include moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help investors assess market momentum and potential price breakouts or corrections.

- Fundamental Analysis Fundamental analysis involves evaluating the underlying economic and financial factors that influence gold prices. This includes analyzing data on inflation rates, GDP growth, interest rates, and geopolitical events. By understanding the broader economic landscape, fundamental analysts can gauge the likely impact of these factors on gold prices and provide insights into potential price movements in 2025.

- Sentiment Analysis Sentiment analysis involves measuring the mood of the market by analyzing news, social media, and investor behavior. Tools like the Fear and Greed Index and market sentiment surveys help gauge the level of optimism or pessimism in the market. In times of geopolitical instability or economic uncertainty, gold often experiences a surge in demand as investors seek safety. Sentiment analysis can help predict when such shifts may occur.

Expert Strategies for Investing in Gold in the Coming Year

For investors looking to capitalize on the trends in the gold market in 2025, experts offer several strategies:

- Diversification One of the best ways to manage risk when investing in gold is through diversification. Rather than putting all your funds into a single type of gold asset, consider spreading your investments across gold bullion, gold ETFs, gold mining stocks, and even gold jewelry. Diversifying your holdings will help mitigate risks and offer greater opportunities for returns in various market conditions.

- Timing Purchases Timing is key when investing in gold. Experts suggest keeping an eye on market trends and price movements to make informed buying decisions. If gold prices dip temporarily due to market fluctuations or short-term corrections, this may present a buying opportunity. Conversely, if gold prices are in a strong uptrend, it may be worth waiting for a pullback before entering the market.

- Hedging with Gold Futures For more sophisticated investors, gold futures contracts offer a way to hedge against potential risks and gain exposure to the price of gold. These contracts allow investors to lock in a future price for gold, enabling them to profit from upward price movements. However, futures trading can be complex and requires a solid understanding of the markets.

- Long-Term Investment Approach While short-term price movements can be unpredictable, gold remains a long-term store of value. Many experts recommend a buy-and-hold strategy, particularly for those looking to hedge against inflation and economic uncertainty. Over the long run, gold has historically proven to be a reliable asset that retains its purchasing power and acts as a safe haven during periods of market turmoil.

Conclusion: What to Expect for Gold Prices in 2025

Gold is poised to continue playing a vital role in investment portfolios in 2025. The combination of inflationary pressures, geopolitical instability, and demand from emerging markets is expected to support gold’s upward momentum. While the price of gold can be volatile in the short term, the longer-term outlook remains positive as investors continue to seek a hedge against economic uncertainties.

By understanding the key drivers of gold prices, utilizing technical and fundamental analysis, and employing expert strategies for investing, investors can position themselves for success in 2025. Whether you’re a seasoned gold investor or a newcomer to the market, keeping a close eye on these factors will be essential to making informed investment decisions in the year ahead.