Key Patterns from the 1970s: Inflation, Uncertainty, and Gold’s Ascent

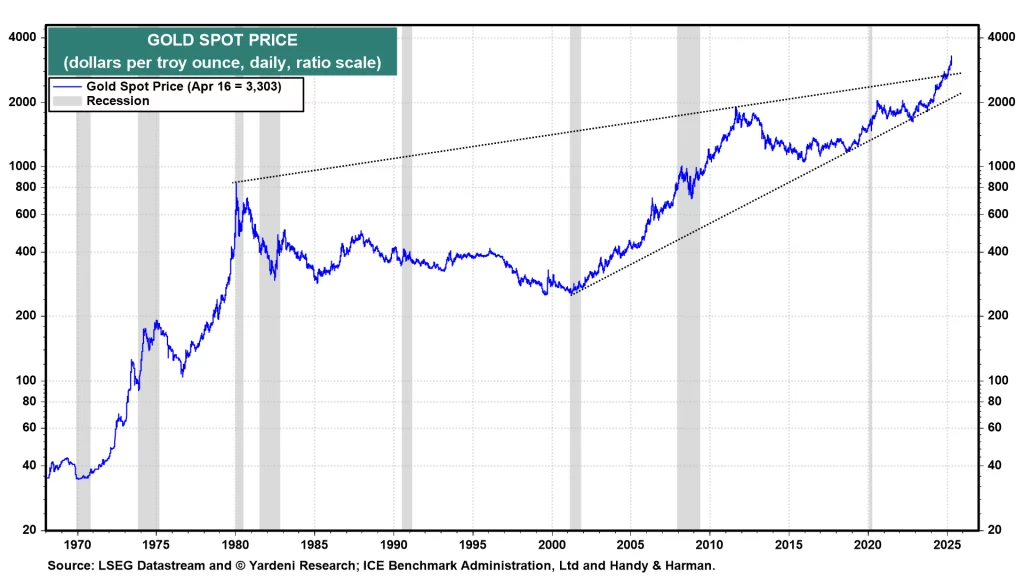

The 1970s were a defining decade for gold, establishing much of the narrative that surrounds the metal’s role as a safe haven. A combination of skyrocketing inflation, geopolitical instability, and fundamental changes to monetary policy pushed gold prices to unprecedented levels. In 1971, President Richard Nixon ended the Bretton Woods system, severing the U.S. dollar’s direct convertibility to gold. This monumental shift unleashed gold from its long-fixed price of $35 per ounce, allowing market forces to dictate its value. As inflation soared throughout the decade, fueled by oil crises and expansive government spending, gold responded dramatically. By 1980, gold reached a then-historic peak of around $850 per ounce. Analysts often point to the 1970s as the purest example of gold acting as a hedge against monetary debasement. During that period, traditional investments like equities and bonds struggled to keep pace with inflation, while gold’s value multiplied exponentially. Another important lesson from the 1970s was the role of investor psychology. As confidence in fiat currencies declined, the rush into tangible assets like gold intensified. Panic buying, fueled by fears of continued inflation and political turmoil, further amplified gold’s price movements. This feedback loop between inflationary fears and gold investment remains highly relevant today, especially as modern economies grapple with rising prices and fiscal uncertainties.

Key Patterns from the 2000s: Financial Crises and Renewed Faith in Gold

Fast-forward to the early 2000s, and a new era of gold enthusiasm emerged. This time, the drivers were somewhat different but equally compelling. After the tech bubble burst in 2000, and especially following the 9/11 attacks in 2001, global markets entered a period of profound instability. Investors sought safety in gold, pushing its price gradually higher. However, it was the 2008 Global Financial Crisis that truly reignited gold’s status as a premier safe haven asset. As major financial institutions collapsed and central banks unleashed unprecedented monetary stimulus, fears of systemic risk and currency devaluation surged. Gold, seen as a hedge against both systemic collapse and inflation, benefited enormously. From around $600 per ounce in early 2007, gold prices surged to over $1,800 per ounce by 2011. Analysts studying this period highlight two key dynamics: first, the importance of monetary policy and second, the interconnectedness of global markets. Ultra-low interest rates, quantitative easing, and vast liquidity injections made traditional safe assets like government bonds less attractive on a real-return basis. Consequently, gold’s appeal, particularly among institutional investors, soared. Moreover, this era emphasized gold’s role as a hedge not only against inflation but also against deflation and currency crises. The U.S. dollar’s strength often seesawed, but gold managed to thrive as investors feared financial system vulnerabilities, not just consumer price increases. Importantly, the 2000s also introduced new vehicles for gold investment. The launch of gold-backed exchange-traded funds (ETFs), like SPDR Gold Shares (GLD) in 2004, revolutionized gold ownership, making it more accessible to retail and institutional investors alike. The increased liquidity and ease of access significantly amplified gold’s market depth and global demand.

Key Patterns from the Post-Pandemic Market: New Drivers, Old Lessons

The COVID-19 pandemic ushered in yet another transformative era for gold. Early in 2020, as the world faced unprecedented lockdowns and economic paralysis, gold initially experienced a sharp selloff along with equities, reflecting a scramble for liquidity. However, once central banks, led by the U.S. Federal Reserve, unleashed massive stimulus programs, gold embarked on a powerful rally. By August 2020, gold hit a new all-time high of over $2,070 per ounce. Several critical themes from the post-pandemic market echo lessons from previous decades, albeit with modern nuances. First, the scale of fiscal and monetary intervention dwarfed anything seen in the 2008 financial crisis, reigniting fears of long-term inflation and currency debasement. Second, the fragility of global supply chains and rising geopolitical tensions—from U.S.-China trade wars to the conflict in Ukraine—added a new layer of demand for safe haven assets. Interestingly, the post-pandemic period also highlighted the increasing role of central banks as major buyers of gold. According to the World Gold Council, 2022 saw record levels of central bank gold purchases, driven by a desire to diversify away from the U.S. dollar and safeguard reserves. This behavior mirrored historical periods when sovereign entities turned to gold to fortify financial stability in uncertain times. Another notable development in the post-pandemic era is the growing interest in gold among younger investors, many of whom initially gravitated toward cryptocurrencies as an inflation hedge. However, the extreme volatility of digital assets has led to a reappraisal, with gold once again being viewed as a more stable store of value. Moreover, the environmental, social, and governance (ESG) movement has begun to influence gold mining practices, with ethical sourcing and sustainability considerations becoming increasingly important to modern investors. This shift could impact supply dynamics in the years to come, introducing a new variable into the traditional gold market equation.

What Historical Trends Tell Us About Today’s Market

Comparing the 1970s, 2000s, and post-pandemic market conditions reveals several enduring truths about gold. Firstly, gold tends to thrive in environments characterized by high uncertainty—whether driven by inflation, financial instability, or geopolitical risk. While the specific catalysts vary across decades, the underlying investor psychology remains remarkably consistent: in times of doubt, tangible assets like gold become highly desirable. Secondly, the interaction between monetary policy and gold prices is pivotal. Loose monetary policy, negative real interest rates, and aggressive fiscal stimulus have historically created fertile ground for gold price appreciation. Today’s environment, with persistent inflation and central banks balancing rate hikes against recession fears, mirrors aspects of both the 1970s and the 2000s, suggesting a continued favorable backdrop for gold. Thirdly, structural shifts in investment access—such as the rise of ETFs in the 2000s and the increased participation of central banks post-pandemic—have expanded and diversified gold’s investor base. These changes enhance liquidity and price discovery but also mean that gold is now influenced by a wider array of market forces. Finally, while gold’s role as an inflation hedge is well-documented, experts caution that it is most effective during periods of unexpected inflation rather than predictable price rises. The interplay between inflation expectations, real interest rates, and investor sentiment will continue to be crucial in determining gold’s trajectory. Today’s market, marked by persistent inflationary pressures, geopolitical fragmentation, and evolving monetary policies, suggests that gold’s traditional role remains highly relevant. Investors who understand the historical patterns can better navigate the complexities of the current environment, using gold strategically within diversified portfolios to hedge against both expected and unforeseen risks.

Conclusion

The lessons from gold’s performance across decades are clear: while the economic and geopolitical contexts may change, the fundamental drivers of gold demand remain surprisingly consistent. High inflation, monetary instability, financial crises, and geopolitical uncertainty have all historically propelled gold prices higher. As the world faces a new set of challenges in 2025 and beyond—ranging from inflationary pressures to potential currency realignments and persistent geopolitical tensions—gold’s time-tested role as a store of value and portfolio stabilizer is likely to endure. Investors attuned to historical patterns and mindful of evolving market dynamics can position themselves to benefit from gold’s enduring appeal, ensuring that this ancient asset continues to shine in the modern financial landscape.